The introduction of cutting-edge digital tools and technologies has revolutionized the business ecosystem in the last few years. As in any other industry, Property Management is also enjoying the benefits of these innovations. Whether you’re a property manager or landlord, using suitable software can simplify managing your properties. Imagine doing your job without a computer now. Seems impossible, isn’t it? Going back to the traditional pen-and-paper method is practically unimaginable today. Considering the ease of operation a simple spreadsheet brings to your processes, think of all the benefits you will be getting from the advanced tools. However, it is okay to have concerns. And we are here to help you with them. Does your business already work with QuickBooks desktop integration software? Then you are halfway there. This popular accounting software can help you with property management. But the question is, how? Read on to find the answers.

Before we delve into the explanation, let us find out a little more about the software.

1. What is QuickBooks?

QuickBooks is arguably the leading accounting software in today’s time. A full-featured business and financial management suite complete with tools for accounting, inventory, payroll, tax filing, invoicing, bank account tracking and reconciliation, expense management, budgeting, payment processing, accounts receivable and accounts payable management, and many more functionalities, QuickBooks takes care of all your accounts and bookkeeping tasks with unbelievable ease.

That feature set is not a complete list of what QuickBooks can do. It can also plug into many additional software tools for added features. QuickBooks can be regarded as the Swiss Army Knife of business financial tools—it can do just about anything you might need for your business, including property management.

QuickBooks offers both a desktop version for a fixed fee as well as QuickBooks online integration version accessible through your web browser, tablet, or smartphone for a monthly or yearly subscription. Some features, such as payroll management and payment processing, incur an additional fee regardless of which version you choose.

2. Is QuickBooks the Right Tool for Property Management?

If you feel like your property management endeavor requires more holistic property management software, this leads to more concerns. All your financial systems work with QuickBooks, and you don’t want to switch. Will make a change from QuickBooks to a new property management system force you to run two parallel software programs to manage customer needs with those of the business? The decision rests on how well each type of software works for your specific business needs and whether you can integrate the different software systems.

The task is not as confusing to your respite as it might sound, and QuickBooks can take care of both tasks seamlessly. To explain, can QuickBooks work as a property management software? The short and simple answer is yes. QuickBooks does have the capacity to be used for managing rental property accounting transactions. The software lets you set up properties as customers, tenants as sub-customers, and classes to track various transaction types. Specifically, it is best used by a property manager handling small to midsize properties.

3. How Do You Use QuickBooks for Property Management?

The first and most important thing to get right in QuickBooks is to make sure you set up two separate company files:

Your business: This is your property management business, where you accept payment for your services and issue payments to owners, etc.

Your service: This is your rental property management service, including collecting rent payments, accepting security deposits, paying for maintenance and repairs, other fees, and anything else involved in managing the properties for your owners.

Therefore, It is vital that you keep these two parts of your business separate. Your accounting reports will be muddled if you don’t, and it will be virtually impossible to distill out any valuable insights. Once you get this done, you will need to go through these steps to use QuickBooks for essential property management accounting functions, including setting up your property and tenants and recording transactions in QuickBooks.

4. Setting Up Your Property Management Company File in QuickBooks

Step 1: Set Up Each Property Owner as a Customer

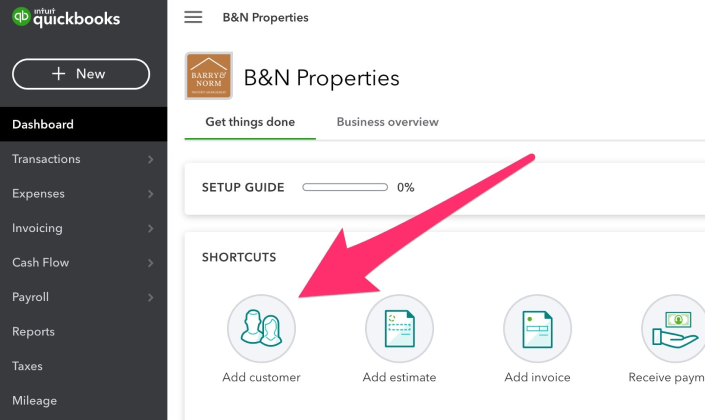

- On the QuickBooks dashboard, click on “Add customer” under the shortcuts section.

- Next, plug in all your client’s information.

- Then click “Save” and repeat these steps for the rest of your clients.

Step 2: Add Your Accounts

- Start by going to your chart of accounts, which you can get to by clicking on the sidebar under “Accounting.”

- Then, click “New” to create a new account.

- Next, select the proper primary account from your chart of accounts. QuickBooks will automatically create one for you, but it may not be ideally suited for property management. So, you will have to name and describe it in an easily identifiable way.

- Once you’ve finished creating your accounts, you’ll be able to view them on the chart of accounts page. Make sure to do this for all relevant accounts. This could include assets such as equipment, liabilities such as payroll, and expenses such as utilities, rent, and insurance.

Step 3: Add Your Service(s)

This is where you prepare to create and send invoices. To do this, you will need to create a service first. Once you set up your services, go on to

- Click on “Invoice” on the sidebar menu

- Next, click on the “Products and Services” navigation item at the top right

- Then, click “New.”

- Fill in the service name

- Hit save

Step 4: Create Invoices and Record Income

At this stage, you are ready to generate invoices and accept payments. To do that, you will have to go back to the main dashboard. Once you are there:

- Click on “Add Invoice”

- Your customer information will already be on QuickBooks by this point

- Next, click on the customer drop-down menu

- Select the client you’re billing

- Input the amount

- Add any additional notes, if required

- Finally, hit send

Once you receive the payment, do not forget to click on the invoice again and select “Receive payment” so it reflects in QuickBooks.

5. Setting Up Your Rental Property Management File in QuickBooks

Next, let’s set up the company file you’ll use to manage your properties. As mentioned earlier, you’ll use this company file to record all transactions related to the properties you manage. This includes:

- Collecting rent payments

- Collecting other payments and fees such as pet rent, parking fees, etc.

- Recording security deposits

- Paying for maintenance, repairs, and upgrades

- And more

To manage these, go through the following steps:

Step 1: Set Up Properties

- Since QuickBooks is not designed for property management, there is no way to add properties specifically. Instead, you’ll need to add each property as a customer.

- Once again, click on “Add customer.”

- Then, fill in the property information (just a name or address will suffice)

Step 2: Set Up Tenants

To add tenants, you’ll need to once again go back to your dashboard, click “Add customer,” and input their information to add each tenant as an individual customer.

Step 3: Set Up Property Owners as Vendors

- From the main menu, navigate to “Expenses” then to “Vendors,”

- Next, click on “Add vendor manually.”

- Click “Save”

Step 4: Set Up Accounts and Services

- Navigate to “Accounting”

- Select “Chart of accounts” from the menu

- Click “New” to create a new account

- Select the proper primary account from your chart of accounts

Once you’ve done this, you can start collecting rent payments by creating invoices, just like we did in the last section.

Before We Wrap Up