Global Meat Processing Equipment Market is expected to reach the market valuation of USD XX billion by 2027 expanding at a reasonable CAGR of XX% during the forecast period (2021-2027) from USD XX million in 2020. Meat Processing Equipment are becoming increasingly popular as a result of increasing packaged food demand. Meat Processing Equipment equipment is a type of food processing equipment used to process meat to enhance its taste and shelf life. Rising investments in the automation of Meat Processing Equipment machinery in countries, such as Japan, India, the U.K., Germany, and the U.S., are likely to spur the demand for Meat Processing Equipment equipment. For instance, in November 2019, Marel opened its new production center in Dongen, Netherlands, because the former location in Dongen no longer met contemporary standards. Therefore, the realization of the new product center was an initiative taken by the company to improve its efficiency.

Request for Sample of the report browse through https://univdatos.com/get-a-free-sample-form-php/?product_id=10014

World total meat exports reached 38.7 million tones, up 5.7 percent from 2019, albeit slower than the 7.4 percent growth registered in 2019. Asia’s imports expanded by 15.8 percent to over 22 million tones, accounting for 63 percent of global meat imports, principally driven by the continued ASF impacts on East Asia’s pig meat production. Induced by the deficit, meat imports by China rose by 57.6 percent, to 11.7 million tones, with pig and poultry meats rising the most.

For a detailed analysis of the market drivers in Meat Processing Equipment browse through https://univdatos.com/report/meat-processing-equipment-market/

The COVID-19 pandemic has caused disruption in supply chain worldwide. This has had a profound impact on Meat Processing Equipment. The rising spread of the virus led to strict lockdown restrictions across many countries around the globe. The rising spread of the virus led to strict lockdown restrictions across many countries around the globe. The supply chain and logistics were harmed as a result of the closing of borders across numerous countries. For instance, according to ISM in 2020, There were 4,200 disruptions in the first nine months of 2020. There is a 14% increase over the number of 2019 supply chain disruptors which was 3,700.. It has resulted in significant disruptions to businesses and economic activities globally and is expected to have a short-term negative impact on the Meat Processing Equipment market due to limited or non-availability of transportation of meat and processing equipments. This aspect led to a decrease in the growth rate of the Meat Processing Equipment market. As per Reuters, the plastic recycling businesses have shrunk, by more than 20% in Europe, by 50% in parts of Asia and as much as 60% for some firms in the United States.

However, as per the US Department of Agriculture (USDA), food-at-home spending (food purchased from supermarkets, convenience stores, warehouse club stores, supercenters, and other retailers) increased from USD 808.0 billion in 2019 to USD 876.8 billion in 2020, due to lockdown. This trend increased the demand for Meat Processing Equipment equipment’s demand

For a detailed analysis of the COVID-19 Impact on Meat Processing Equipment browse through https://univdatos.com/report/meat-processing-equipment-market/

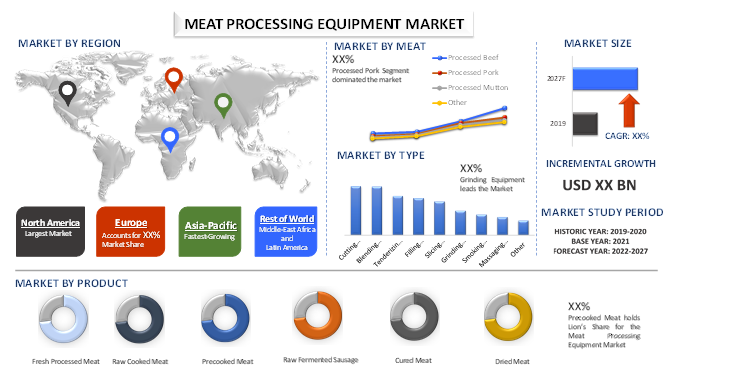

Based on type, the market is fragmented into into into cutting equipment, blending equipment, tenderizing equipment, filling equipment, slicing equipment, grinding equipment, smoking equipment, massaging equipment, and other. The grinding segment dominated the market in 2020 and generated total revenue of USD XX billion. It is anticipated to maintain its position owing to the rising demand for packaging material in consumer goods, food & beverage, and various other industries.

Based on the meat, the market is fragmented into processed beef, processed pork, processed mutton, and other. The processed pork segment dominated the market in 2020 and generated total revenue of USD XX billion. It is anticipated to maintain its dominance during the forecast period since processed pork is cheaper than processed beef and tastes better than processed mutton.

Based on product, the market is fragmented into fresh processed meat, raw cooked meat, precooked meat, raw fermented sausage, cured meat, and dried. The precooked meat segment dominated the market in 2020 and generated total revenue of USD XX million. It is anticipated to maintain its dominance during the forecast period as these products utilize a variety of meat parts, various products are offered in this category.

Request for Sample of the report browse through https://univdatos.com/get-a-free-sample-form-php/?product_id=10014

Additionally, the report provides detailed initiatives that are being taken in the field of Meat Processing Equipment. The market is classified into distinct regions North America (United States, Canada, and the Rest of North America), Europe (Germany, France, Italy, Spain, United Kingdom and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and Rest of APAC), Rest of World has been conducted. North America held the major share of the market and generated revenue of USD XX million in 2020 on account of the rising demand for processed meat, the growing investment in Meat Processing Equipment facilities, and the presence of a large number of meat processors, such as Tyson Foods, Cargill Meat Solutions Corp., and JBS USA in this region.

Major key players include includes GEA Group Aktiengesellschaft, The Middleby Corporation, Heat and Control, Inc, Marel, Key Technology, Inc, JBT Corporation, Illinois Tool Works Inc. (ITW), Bettcher Industries, Inc, Welbilt, Mepaco Group are some of the prominent players operating in the global Meat Processing Equipment market. Several M&A’s along with partnerships have been undertaken by these players to develop Meat Processing Equipment.

Global Meat Processing Equipment Market Segmentation

Market Insight, by Type

· Cutting equipment

· Blending equipment

· Tenderizing equipment

· Filling equipment

· Slicing equipment

· Grinding equipment

· Smoking equipment

· Massaging equipment

· Other

Market Insight, by Meat

· Processed beef

· Processed pork

· Processed mutton

· Other

Market Insight, by Product

· Fresh processed meat

· Raw cooked meat

· Precooked meat

· Raw fermented sausage

· Cured meat

· Dried

Market Insight, by Region

· North America

o United States

o Canada

o Rest of North America

· Europe

o France

o Germany

o Italy

o Spain

o United Kingdom

o Rest of Europe

· Asia-Pacific

o China

o Japan

o India

o Australia

o Rest of Asia-Pacific

· Rest of World

Top Company Profiles

· GEA Group Aktiengesellschaft

· The Middleby Corporation

· Heat and Control, Inc

· Marel

· Key Technology, Inc

· JBT Corporation

· Illinois Tool Works Inc. (ITW)

· Bettcher Industries, Inc

· Welbilt

· Mepaco Group